Our services include:

Frequently asked questions

We provide personalized knowledge and expertise specifically designed for your business goals

What is VAT (Value added Tax)?

VAT is a general consumption tax, which is supposed to be ultimately borne by the end consumer. The VAT system is designed in such way that all parties in the supply chain are charged with VAT, but only the ultimate consumer is not able to recoup the paid VAT. So, in general, VAT must be included on all invoices throughout the supply chain. The seller receiving the VAT from his client acts as the withholding agent for the Dutch tax authorities. The standard rate is 21%. A reduced rate of 9% applies to basic goods and services. Exports and certain services rendered in connection with exports are zero rated.

Is my company liable to pay VAT when importing goods into the Netherlands from outside the EU?

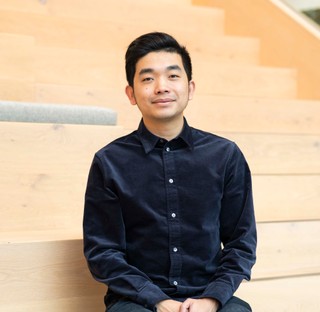

Our team

The people that make it possible

Testimonials

What our clients say about us

Connect with us today

Start your journey in Europe with us

Get in touch with us

Bart Brinkman will answer your e-mail as soon as possible

The Netherlands

Amsterdam (HQ)

Coen Buildling

Kabelweg 37

7th Floor

1014 BA

Rotterdam

Groot Handelsgebouw

Stationsplein 45, CIC

3013 AK

The Hague

WTC Business Center

Pr. Margrietplantsoen 33

2595 AM

Eindhoven

High Tech Campus 37

5656 AE Eindhoven

The US

811 W 7th street

Los Angeles CA, 90071

The UK

167-169 Great Portland

London, W1W 5PF